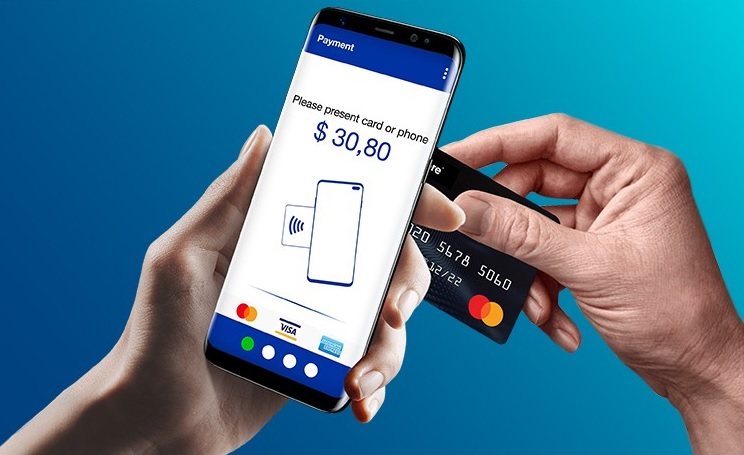

In today’s era, hong leong bank mobile transactions have become popular, offering the convenience and flexibility to make payments on the go . Whether it’s shopping, bill payments, or transferring funds, mobile transactions provide a seamless and secure way to manage finances. This article serves as a comprehensive guide for Malaysians, explaining the advantages, importance, and step-by-step process of making mobile transactions, empowering individuals to embrace the digital revolution.

Advantages of Making Mobile Transactions in Malaysia

1. Convenience and Accessibility:

Mobile transactions offer unparalleled convenience, allowing Malaysians to make payments anytime, anywhere. With mobile banking apps and e-wallets, individuals can manage their finances, transfer funds, and make purchases with just a few taps on their smartphones. The accessibility of mobile transactions makes it a preferred method for users looking for quick and hassle-free financial transactions.

2. Enhanced Security:

Mobile transactions in Malaysia are designed with robust security measures to protect user information and financial data. With features like biometric authentication, encryption, and tokenization, mobile transactions offer secure platforms for financial activities. Users can have peace of mind knowing that their personal and financial information is safeguarded during transactions.

How to Make a Mobile Transaction in Malaysia

Step 1: Choose a Mobile Payment Method

In Malaysia, several mobile payment options are available, including e-wallets and mobile banking apps. Research and choose a reliable and widely accepted payment method that aligns with your preferences and needs.

Step 2: Download and Set Up the App

Download the chosen mobile payment app from the app store onto your smartphone. Follow the registration process and provide the necessary information to set up your account.

Step 3: Link Your Bank Account or Add Funds

Link your bank account to the mobile payment app or add funds to your account. This step may require verifying your identity and providing relevant banking details.

Step 4: Explore Available Services

Once your account is set up, explore the services offered by the mobile payment app. This can include making purchases at retail stores, online shopping, bill payments, or transferring funds to other users.

Step 5: Initiate a Mobile Transaction

To make a mobile transaction, follow the prompts within the app. For retail purchases, scan the QR code provided by the merchant or enter the necessary details. For online transactions, select the mobile payment option during the checkout process.

Step 6: Confirm and Authenticate the Transaction

Before completing the transaction, review the details and ensure accuracy. Authenticate the transaction using the provided security features, such as biometric authentication or PIN codes.

Conclusion:

Mobile transactions in Malaysia offer undeniable advantages, including convenience, accessibility, and enhanced security. By understanding the step-by-step process of making mobile transactions, Malaysians can embrace the digital revolution and enjoy seamless financial experiences.

Whether it’s using e-wallets or mobile banking apps, mobile transactions provide a convenient and secure way to manage finances, make purchases, and transfer funds. Embrace the future of finance by incorporating mobile transactions into your daily life, and stay ahead in the rapidly evolving digital landscape.

Recent Comments